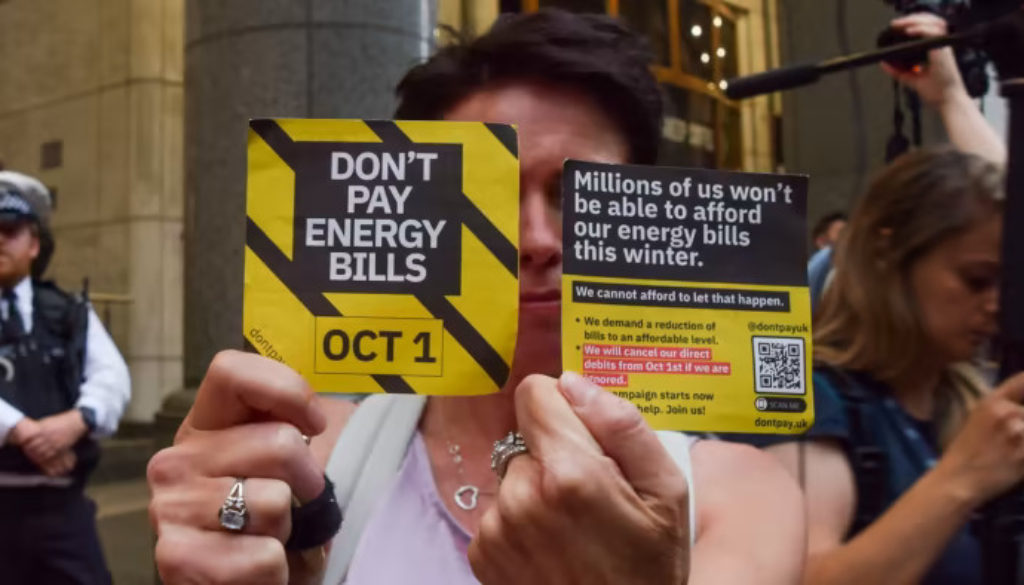

One million people may refuse to pay their energy bills from 1st October

One million people may cancel their direct debit payments to energy companies en masse on 1st October. Are there any Cypriots among them? It would be very interesting to hear what they think and what they are planning to do.

More than thirty years ago, Miranda Kemp, a charity worker, had refused to pay the unpopular poll tax imposed by Margaret Thatcher. Now she is a member of the “Don’t Pay” movement.

Warnings about Britain’s soaring energy bills grow by the day and Don’t Pay is a grassroots movement that is simply urging consumers to go on strike.

Don’t Pay hopes to amass a million supporters who will cancel their direct debit payments to energy companies en masse on October 1. Since mid-June it has attracted more than 130,000 supporters.

“We’ve got very little power in this situation as a consumer, so I feel like it’s all you can do to say ‘actually, I can’t afford this and I’ve got to do something about it’,” Miranda said.

Don’t Pay is one of a number of protests against the soaring cost of living in the UK. Barristers, train drivers and postal workers are striking for improved pay and work conditions. Nurses and teachers are also balloting to take action.

Meanwhile, the broader trade union-backed campaign “Enough is Enough” is demanding fairer pay across the board, lower energy bills, better housing and higher taxes on the rich.

The Don’t Pay campaign, which has echoes of the “Can’t Pay, Won’t Pay” payment strike following Margaret Thatcher’s failed attempt to introduce the poll tax in the late 1980s, has been called “irresponsible” by the government and elicited warnings that it could harm credit scores and lead to more expensive fuel repayments.

Martin Lewis, consumer rights champion, had warned, weeks before Friday’s announcement that the energy price cap would rise to £3,549 from October, that boycotts and consumer strikes could gain traction if the government failed to offer more support to British households.

“Once it starts becoming socially acceptable not to pay energy bills, people will stop paying energy bills – and you’re not going to cut everyone off,” he said.

In May, the government announced a £15bn package of measures, including a £400 discount on all energy bills, based on an energy price cap of £1,971.

However, the cap will jump by 80% to £3,600 in October, and Rishi Sunak and Liz Truss, the candidates to become the next UK prime minister, have so far proposed limited measures to address the crisis.

The risks

Don’t Pay said the aim of their campaign was not “never paying”, but temporary “leverage”. They also stressed that people on prepayment meters, who are often on low incomes, should not participate because they could have their power supply cut.

Campaign organisers argue that disconnection for households that take part in the protest is “extremely unlikely”. But they admit there are risks, including protesters being forcibly moved on to prepayment meters because they cancelled their direct debits. They add that non-payment may also harm a person’s credit score.

Frankie Stocks, a 21-year-old Don’t Pay activist in Manchester, was homeless until a few months ago and said the risk to credit ratings was moot for many households.

“How can you expect people like me to worry about protecting their credit rating?” he said, pointing out that he’s far from “putting money into an ISA” to buy a home.

He said there was a “rich history” of similar strikes elsewhere, pointing to a 2011 mortgage strike campaign in Ireland. “It’s nothing new,” he added. “Consumer strikes have been going on for decades.”

Gillian Cooper, head of energy policy at the charity Citizens Advice, said she was hearing from people every day who were “running out of options” for paying their energy bills. But she warned that “it’s important to know that there can be serious consequences if you build up arrears”.

“Your energy supplier can move you on to a prepayment meter or, in rare cases, even disconnect you.”

Direct debit cancellation could lead to a household being moved on to a more costly tariff, while longer-term arrears could result in the involvement of a debt collector or eventually a county court judgment, the CAB said.

According to Cooper, the Don’t Pay campaign was “yet another indicator of the pressures people are under”. She urged the government to provide more financial support to households and energy companies “to do everything they can to help customers and not chase them for debts they can’t pay”.

Kemp’s bills had doubled in the past year. She said she was “confident” government and energy companies would intervene by October 1. But if not, she would cancel her direct debit in solidarity with others, as much as for herself.

“I think it’s a disgraceful situation, really, and I’m just hoping the government, whoever becomes prime minister, gets on top of it as soon as they can.”

A spokesman for the Department of Business, Energy and Industrial Strategy said: “This is highly irresponsible messaging, which ultimately will only push up prices for everyone else and affect personal credit ratings.

“While no government can control global gas prices, we are providing £37bn of help for households including the £400 discount on energy bills, and £1,200 of direct support for the most vulnerable households to help with the cost of living.”